August 14, 2023

Regardless of the dark clouds over Kenyan economy, the banking sector is performing relatively well

Finnfund’s strategy places a strong emphasis on Africa, with half of the investments in the continent. Kenya is one of the important markets in East Africa and that is why we opened a regional office in Nairobi in 2022. The Kenyan economy is experiencing challenging times and Finnfund’s Economist Nea Tiililä took a closer look into Kenyan economic situation.

Kenyan economy has been developing steadily over the past decade with the help of foreign investors. Nowadays Kenya is the biggest economy in East Africa and a regional transportation, trade and financial hub. However, the recent extremely challenging macroeconomic years have taken a toll on the economy. During Covid-19, lockdowns and restrictions hurt the businesses and economy leading to a negative GDP growth for the first time since the early 1990s. During the economic slowdown government spending went up, while revenues decreased. This deepened the fiscal deficit and Kenya had to apply for funding from the IMF. The real economy showed resilience and rebounded strongly in 2021 but the impact on public finances was more persistent.

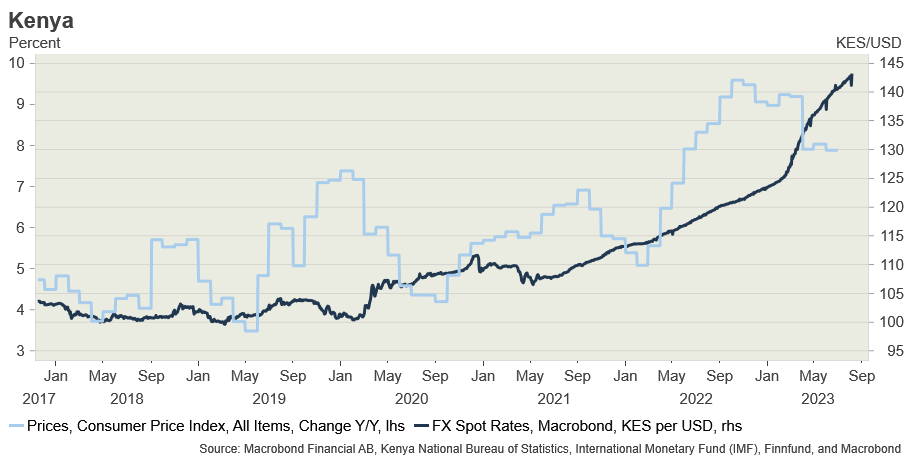

In 2022, the Russian invasion to Ukraine, supply chain bottlenecks, global inflation and tightening financing conditions created the next major shock to the economy. Year 2022 was also an election year in Kenya which further increased uncertainty. Kenya is an import dependent country with food and especially fuel being major imports. As the food and fuel prices rocketed in 2022, also the import bill grew significantly. This, together with the appreciating dollar, created significant pressure for the Kenyan shilling which has been depreciating in an accelerating pace over the last two years (see graph). Regardless of the various challenges, the real economy has remained resilient and medium-term growth is expected to be robust, with around 5% annual growth. Inflation is expected to peak in 2023 and then gradually decelerate towards a long-term average of 5,5-6% 1.

The main worry for the outlook is the debt challenges Kenya is facing

In 2010s, when Kenya, among many other frontier markets, gained access to international capital markets, the public debt levels started to rise, hitting 68% of GDP in 2022. The split between domestic and external debt is around half and half. Debt service costs, (with amortization) exceeding 50% of revenue today, are increasingly narrowing down public spending 2. Kenya is facing a potential debt repayment crunch in summer 2024, when a $2bn Eurobond is maturing and needs to be repaid 3. To redeem the Eurobond, Kenya would need refinancing from the international markets or other alternative loans to build up its decreasing foreign-exchange reserves. What complicates redemption, is that Kenya had not had access to international capital markets from 2020 until in June 2023 when it secured a $500mln loan from international banks. Kenya has also received financing from the IMF and World Bank which helps with the balance of payments pressure, but the multilateral money cannot be directly used to repay other debt.

Kenyan government has been proactive in solving the debt challenges and the Ruto administration has shown that it is able to make difficult decisions in fiscal consolidation. Thus, it is possible that Kenya will be able to build up investor’s trust and attract new financing for the $2bn payment. However, uncertainty remains high. The outcome depends also on developments in global market conditions.

The Kenyan banking sector has remained robust against the headwinds in the financial markets. Years 2022 and 2023 have been difficult given the increased external sector pressure. The shilling has been depreciating heavily, financing costs have increased, and liquidity challenges have emerged. Especially dollar liquidity has been a challenge and during the first half of 2023 the interbank FX market was basically shut down. By now, with the help of a central bank facility, the market has started to partially function again. At the same time, macroeconomic challenges have hit companies and households, resulting to rising NPL levels in the banking sector. Nevertheless, apart from a few smaller banks, the banking sector is managing the pressure and their capital adequacy has remained at a good level.

Finnfund plays an important role in financing sound financial institutions

Amidst these challenges, Finnfund plays an important role in financing sound financial institutions in the Kenyan banking sector. With the financing, local banks in turn improve households’ and micro, small and medium sized enterprises’ (MSMEs) access to financing. Finnfund together with other financial institutions provided long term loan financing to the Co-operative Bank of Kenya with a 7-year funding facility amounting to USD 100 million (Kshs 13,8 billion) 4. Coop is a stable, well-managed and systemically important Tier I bank in Kenya with good market standing, strategic orientation and attractive growth prospects. This financing facility will improve Coop Bank’s liquidity position and help Coop Bank to sail through the challenging economic times and continue lending to MSMEs in Kenya.

Nea Tiililä

Economist

Sources

1 Economic forecast numbers from Fitch Solutions / BMI, retrieved in June 2023

2 IMF debt data and IMF DSA on Kenya

3 After 2024 the next Eurobonds will mature 2027, 2028 and 2032, IMF DSA on Kenya

4 The loan is a Tier II Facility that has already been fully disbursed, where Finnfund acted as Lender. The DEG-led consortium included The Africa Agriculture & Trade Investment Fund (AATIF), Micro Small Medium Enterprises Bonds (MSMEB), Norfund and the co-financing facility European Financing Partners (EFP).

Read more

Finnfund opens its first regional office in Nairobi, Kenya

Finnfund’s investments in financial institutions