June 15, 2023

Finnfund and FMO back SATYA MicroCapital with USD 35 million to make formal finance more accessible to women in India

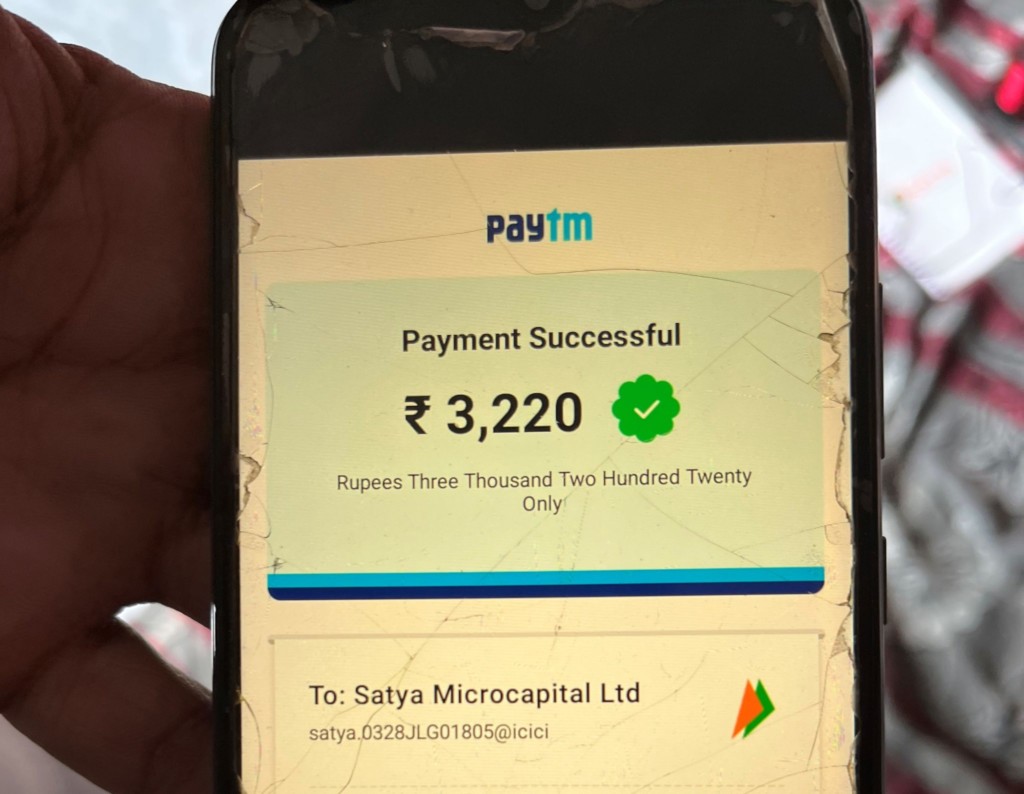

Finnfund, the Finnish development financier and impact investor, and FMO, the Dutch entrepreneurial development bank, have announced a USD 35 million debt funding to SATYA MicroCapital Ltd, a Delhi-based RBI registered NBFC-MFI which provides affordable microcredit to women from low-income households across the rural areas of India. Finnfund invested USD 10 million ECB facility, with FMO providing a USD 25 million debt facility in the local currency. The company contributes to women empowerment by generating additional income earning opportunities and providing a more affordable alternative to informal finance with high interest rates.

“SATYA is an important enabler of financial inclusion, and we are happy to establish a new partnership with them”, says Finnfund’s Investment Associate Kyaw Latt. “We have been impressed by their growth and the way they integrate modern technology into their microfinance operations. The company’s commitment to social mission and empowering women is well aligned with Finnfund’s aim to promote gender equality and strengthen women’s financial independence, especially among the traditionally underserved population in India.”

Aleksandra Gazy, Investment Officer at FMO, added, “We are thrilled to be supporting our new MFI client SATYA with this high-impact transaction. Labelled as 100% Reducing Inequalities and 20% Green, the funds have been earmarked to fund women and youth financing, thereby promoting gender equality and female empowerment. By empowering aspiring women entrepreneurs with increased credit access and digital literacy trainings, SATYA clearly exemplifies the importance of providing both financial and non-financial support to improve the livelihoods of the underbanked across India. We look forward to jointly contributing to the inclusive sustainable development of the Indian economy together with SATYA.”

Vivek Tiwari, MD, CIO & CEO of SATYA MicroCapital says, “The client base of SATYA MicroCapital Ltd is predominantly formed by self-employed rural women nestled in rural and sub-urban terrains. The capital raised will be used in appropriate custom to expand our operations to a broader spectrum thereby providing the much-needed financial access to women micro entrepreneurs for their livelihood rehabilitation. It is a moment of sheer privilege for SATYA MicroCapital Ltd. We are extremely grateful for the unmatched belief Finnfund and FMO have bestowed in our organization. Receiving this sort of infusion validates the business model of any MFI complimented by an exponential boost in its confidence. Definitely this will strengthen investors’ confidence in our dynamic and progressive business model in a much more intensive manner. This fiscal backing will indeed catapult SATYA to socio-economically uplift more than 75,000 households by furnishing affordable and accessible means of micro-credit.”

Many women in India lack access to formal finance: According to the World Bank, only 10% have borrowed from a formal financial institution. SATYA reaches out to rural women in their home villages and helps them access small finance. The clients have been able to increase their annual income by 11% after taking a loan from SATYA. Finnfund and FMO’s investment in SATYA is classified as a 2X Challenge eligible gender investment as the products offered are targeted to empower women and promote female entrepreneurship.

SATYA provides group loans, where family or friends are acting as co-borrowers for the loans. Like many other financial institutions in India, SATYA earlier required that borrowers should be married and widow members needed to have their son acting as a co-borrower. This policy was changed in this year and SATYA has worked on removing the marital status from loan eligibility and implementing changes in their operations to accommodate the policy change. “Including the previously underserved groups like unmarried women and widows is a big step both culturally and business-wise”, says Latt. “Both SATYA and we see the need for change and believe that expanding the client base will help SATYA achieve their vision of being a catalyst for the socio-economic improvement of 5 million households in India by 2025.”

SATYA provides group loans, where family or friends are acting as co-borrowers for the loans. Like many other financial institutions in India, SATYA earlier required that borrowers should be married and widow members needed to have their son acting as a co-borrower. This policy was changed in this year and SATYA has worked on removing the marital status from loan eligibility and implementing changes in their operations to accommodate the policy change. “Including the previously underserved groups like unmarried women and widows is a big step both culturally and business-wise”, says Latt. “Both SATYA and we see the need for change and believe that expanding the client base will help SATYA achieve their vision of being a catalyst for the socio-economic improvement of 5 million households in India by 2025.”

More information:

Kyaw Latt, Investment Associate, Finnfund, kyaw.latt@finnfund.fi, +358 40 631 2941

Media contact:

Valpuri Mäkinen, Communications Manager, Finnfund, valpuri.makinen@finnfund.fi, +358 50 384 2105

About Finnfund

Finnfund is a Finnish development financier and impact investor. We build a sustainable future and generate lasting impact by investing in businesses that solve global development challenges. We invest 200–250 million euros in 20–30 companies in developing countries each year. Our focus sectors include renewable energy, sustainable forestry, sustainable agriculture, financial institutions, and digital infrastructure and solutions. Today Finnfund’s investments, commitments, and investment decisions total about 1.22 billion euros, half of them in Africa. The company has 100 employees based in Helsinki and Nairobi. For more information, please visit www.finnfund.fi

About FMO

FMO is the Dutch entrepreneurial development bank. As a leading impact investor, FMO supports sustainable private sector growth in developing countries and emerging markets by investing in ambitious projects and entrepreneurs. FMO believes that a strong private sector leads to economic and social development and has a 50+ year proven track-record in empowering entrepreneurs to make local economies more inclusive, productive, resilient and sustainable. FMO focuses on three sectors that have high development impact: Agribusiness, Food & Water, Energy, and Financial Institutions. With a total committed portfolio of EUR ~13 billion spanning over 85 countries, FMO is one of the larger bilateral private sector development banks globally. For more information: please visit www.fmo.nl.

About SATYA MicroCapital

Established in October 2016, and headquartered in the capital city of New Delhi, SATYA initiated the course of its operational journey in January 2017.With the foremost and fundamental goal of empowering rural women, both digitally and financially, SATYA has come a long way since its incorporation. Since then, the company has registered an impressive growth by achieving an Assets Under Management (AUM) value of more than Rs. 5000 crores in less than 7 years and Cumulative Loan Disbursement of worth more than Rs. 10,000 crores, thus emerging as one of the fastest growing Highly Technology driven Micro Finance Institutions in the country. The organization’s firm belief in modern technology and its potential to increase efficiency, reduce risks, and enhance overall customer experience is apparent in its adoption of the most cutting-edge innovations to power its operations. SATYA has established its terrestrial footprints via operational network of 449+ branches in near about 50,000 villages across 22 states.

At present, SATYA is furnishing its affordable micro credit services to almost 15 lakhs women entrepreneurs from rural and semi-urban areas who are excluded from traditional banking channels because of their low, irregular, and unpredictable income. The helm of SATYA’s accessible services is to be a catalyst for the socio-economic upliftment of its clients via channelizing income growth and income generation. SATYA is integrally concentrated towards building their financial capacity and ability to grow to financial self-sufficiency. The taskforce of more than 5500+ employees are playing an intrinsic role in SATYA’s ongoing growth trajectory. In addition to yielding financial aid to unbanked sections of the population, SATYA MicroCapital consistently associates with institutions of the same wavelength to disseminate the importance of digital and financial literacy in rural areas.