Responsible tax principles – our work in practice

Finnfund’s responsible tax practices are guided by our tax policy.

Finnfund’s responsible tax practices are guided by our tax policy.

We believe that responsible tax practices are at the core of Finnfund’s work as a development financier and impact investor. Finnfund’s mission is to promote economic and social development in developing countries. For this to take place, target countries require tax revenue and payment of other fees. Tax revenue and other tax-like fees paid by companies to the public sector in developing countries constitute one of the development aims of Finnfund’s work with the companies it finances.

The tax policy is founded on the principle that Finnfund does not support aggressive tax planning, which prevents the accumulation of tax revenue from profitable business activities in developing countries.

In this article, we will go over how Finnfund implements its tax policy in practice – step by step.

“We want to pioneer and promote responsible tax practices and engage in discussion on the topic. This is an important part of our principles of responsibility and work as a development financier. In order to achieve results, we must identify and select the right places and means to impact the world through our investments.”

– Veera Mäenpää, Legal Counsel, Finnfund

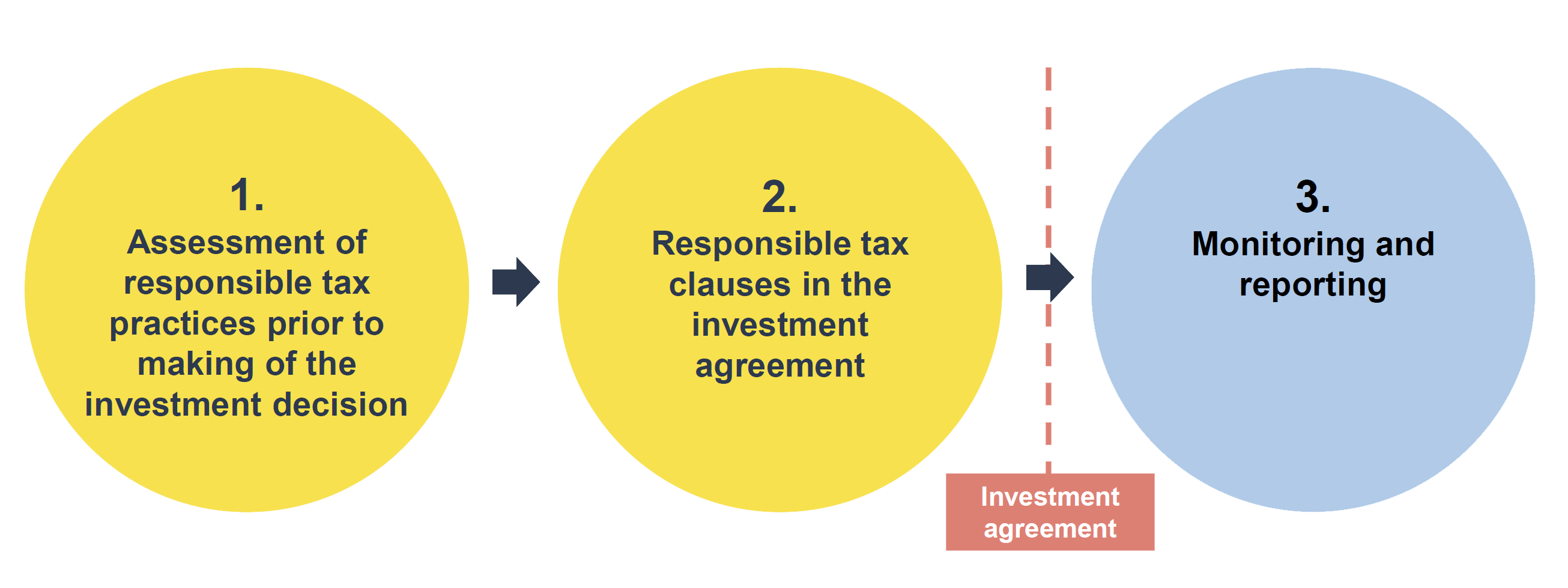

Three steps towards responsible tax practices

Finnfund’s tax policy is implemented in three stages:

1. Assessment of responsible tax practices before investing

Before an investment decision, Finnfund ensures that the project company follows responsible tax practices. This is part of the responsibility and impact assessment process at Finnfund. This stage includes tax due diligence and a tax analysis conducted on the basis of the due diligence.

The assessment of the responsible tax practices is done by way of set of questions. The assessment concentrates on five areas:

- tax holidays and concessions;

- existence and use of holding companies;

- transfer pricing and intra-group transactions;

- thin capitalisation and potential misuse of intragroup loans; and

- hybrid structures weakening responsible tax practices.

The results of the assessment form the basis for the tax analysis, which forms a part of the investment memorandum of the project. Finnfund’s Board of Directors reviews the investment memorandum and decides on the basis of that document whether or not Finnfund will finance the project.

Finnfund assessment focuses particularly on checking whether income tax revenue is generated by the operating results of project company in the developing country in question. Finnfund aims to ensure that its investee companies’ financial returns and taxes paid from those financial returns are not reduced artificially.

At this stage, it is important to concentrate on what is essential and where Finnfund can make an impact in the developing country in question: the goal of our responsible tax assessment is to determine whether or not tax revenues accumulate in the operating country of our project company – which is the aim of our operations.

This also means that Finnfund needs to be aware of its investee companies’, ownership and financial structures. In addition, Finnfund requires that the group structure of the project company’s and its parent are transparent to the local tax authorities. Finnfund also carries out checks on the backgrounds of its co-investors and the identity of the ultimate beneficial owners. It must be noted however, that Finnfund cannot be responsible for its co-investors’ tax arrangements.

Example 1: Company X has been granted a five-year tax holiday from corporate tax. After the tax holiday, the company has a 25% tax relief effective for three years. Finnfund looks into the situation to discover whether the same tax concessions are available to all companies on similar grounds in similar situations in the country in question. If they are, it means that the company is making use of tax planning allowances which all governments are entitled to provide. Tax holidays are commonly granted in specific sectors (e.g. extensive infrastructure projects, industry, renewable energy) and socio-economically poor areas and industrial parks. If the tax concessions are deemed unusual and they are not available to everyone on similar grounds in similar situations, it is against Finnfund’s tax.

Example 2: Company X is selling services to another company in the same group, company Y, which Finnfund finances by a loan. Finnfund wants to make sure that company X is selling the services at a market-based price. If the price is too high, company Y’s revenue and corporate tax will decrease, which, in turn, erodes the tax base in the country in question. This does not comply with Finnfund’s tax policy.

2. Tax clauses in financial agreements

If Finnfund makes an investment decision, clauses on tax structures and reporting are included in the investment agreements.

Finnfund obliges its project companies to report any changes in company structures and internal financing structures and it reserves the right to react to such changes. In addition, Finnfund requires its investees to be transparent about the aforementioned information and report such information to the tax authorities of its host country.

As with other aspects of sustainability, Finnfund’s overall goal is to support companies develop their responsible tax practices and to implement best practices – also in terms of taxation.

Example 3: Finnfund is financing company X. One of the clauses in theinvestment agreement between Finnfund and company X states that company X shall comply with the arm’s length principle in its business activities. In other words, company X’s parent group’s internal sales or purchases must be priced on market terms. If company X has conducted a market price analysis, it is obligated to disclose it to Finnfund.

3. Monitoring and reporting

After concluding the investment agreement, Finnfund monitors the implementation of the responsible tax principles included in the agreement and encourages the project company to develop its own tax policy.

Finnfund also monitors the project company’s payment of taxes and other tax-like fees paid to the country of operation on an annual basis. Finnfund includes this information in its annual report.

Tax regulations and best practices are continuously evolving. Finnfund continues to keep up with the development of international tax regulations, improve its own competence in the area and provide training to its professionals.

Example 4: Before making any financing decisions, Finnfund conducts a tax analysis and has recently included a DAC-6 assessment in its tax analysis process. DAC-6 is one of the 15 measures tackling issues relating to corporate taxation introduced by the so-called BEPS project. It is based on an EU directive and implemented by national law in each country. The goal of the BEPS project is to ensure that companies pay taxes to their country of operation. Finnfund has provided training on the topic to its professionals and included the DAC assessment on whether Finnfund’s funding causes a reporting obligation pursuant to DAC-6 in its tax analysis.

Example 5: Finnfund collects information about the taxes and tax-like fees paid by the companies it finances on an annual basis. The tax footprint of companies financed by Finnfund is published in Finnfund’s annual report. This information is reported on a country-by-country basis. In 2019, companies financed by Finnfund paid 638 million euros in taxes and tax-like fees to their respective countries of operation. You can read Finnfund’s annual reports here.

Read more:

Responsible tax practices: tax policy

Finnfund assesses the implementation and results of its tax policy

Interested to know more about our work in practice?

Climate accounting – our work in practice

Human rights management system – our work in practice

Further information:

Veera Mäenpää, Legal Counsel, veera.maenpaa@finnfund.fi, tel. +358 40 641 1587