|

|

Finnfund Update for Investors

|

|

|

|

|

Dear all,

We are living in exceptional times. I believe it is fair to say that 2022 was an exceptional year in many ways. and to a large extent, it looks like this year continues on the same path.

|

|

In 2022, several simultaneous crises had a global impact: the war in Ukraine, the coronavirus pandemic, political unrest and general economic uncertainty, inflation, and, in particular, rising energy and food prices. This has also been strongly reflected in emerging markets.

|

|

|

|

For us, it has been clear that as a development financier, it is our task to be where we are most needed. Crises shape markets, yet they also offer opportunities.

|

In 2022, we succeeded in operating profitably, exceeding our targets for new projects and, in line with our strategy, increasing both the size and impact of our investment portfolio. At the same time, we’ve kept our investment portfolio net carbon negative, that is, our investments sequester more carbon than they emit. As part of our strategy, we intend to ensure this in the future as well.

|

Dear friends, partners, financiers, and all, I am glad to share our Annual Report 2022 with you. The report collates key information about Finnfund’s financial performance, sustainability, and impact. I hope it also gives you a glance at our mission, strategy, and impact, and in particular, provides you insights from our investee companies and partners.

|

We at Finnfund get our vitality from the successes of our partners, and I wish to thank you for the good cooperation.

|

As you may read in this blog post as well as below, we have had an active spring, and the outlook for the rest of the year remains positive. We have made some exciting new investments, and together with our investee company, launched an innovative pilot project on biodiversity.

|

Welcome to explore our Annual Report and some of the more recent highlights we have gathered below.

|

Jaakko Kangasniemi

Managing Director, CEO, Finnfund

|

|

P.S. We wish you find this quarterly newsletter useful. Should you wish to receive this newsletter in the future but have not yet joined our subscribers, please click here. You can unsubscribe at any time.

|

|

|

|

|

|

Now available: Finnfund Annual Report 2022

|

Finnfund's Annual Report covers key figures, highlights and the latest impact figures from our investment portfolio - as well as gives an overview of our policies and practices.

|

|

|

|

|

|

|

|

|

Investment decisions and disbursements in Q1/2023

|

|

|

|

|

CFO insight into 2022 and Q1: Positive result – positive outlook

|

|

Our Annual Report 2022 has been published, and I am happy to say that despite the global and local economic and political challenges, the year was a successful one. We also started the year 2023 actively. Read more

|

|

|

|

|

|

Annual Report: Finnfund’s investment portfolio grew with a profitable result

|

|

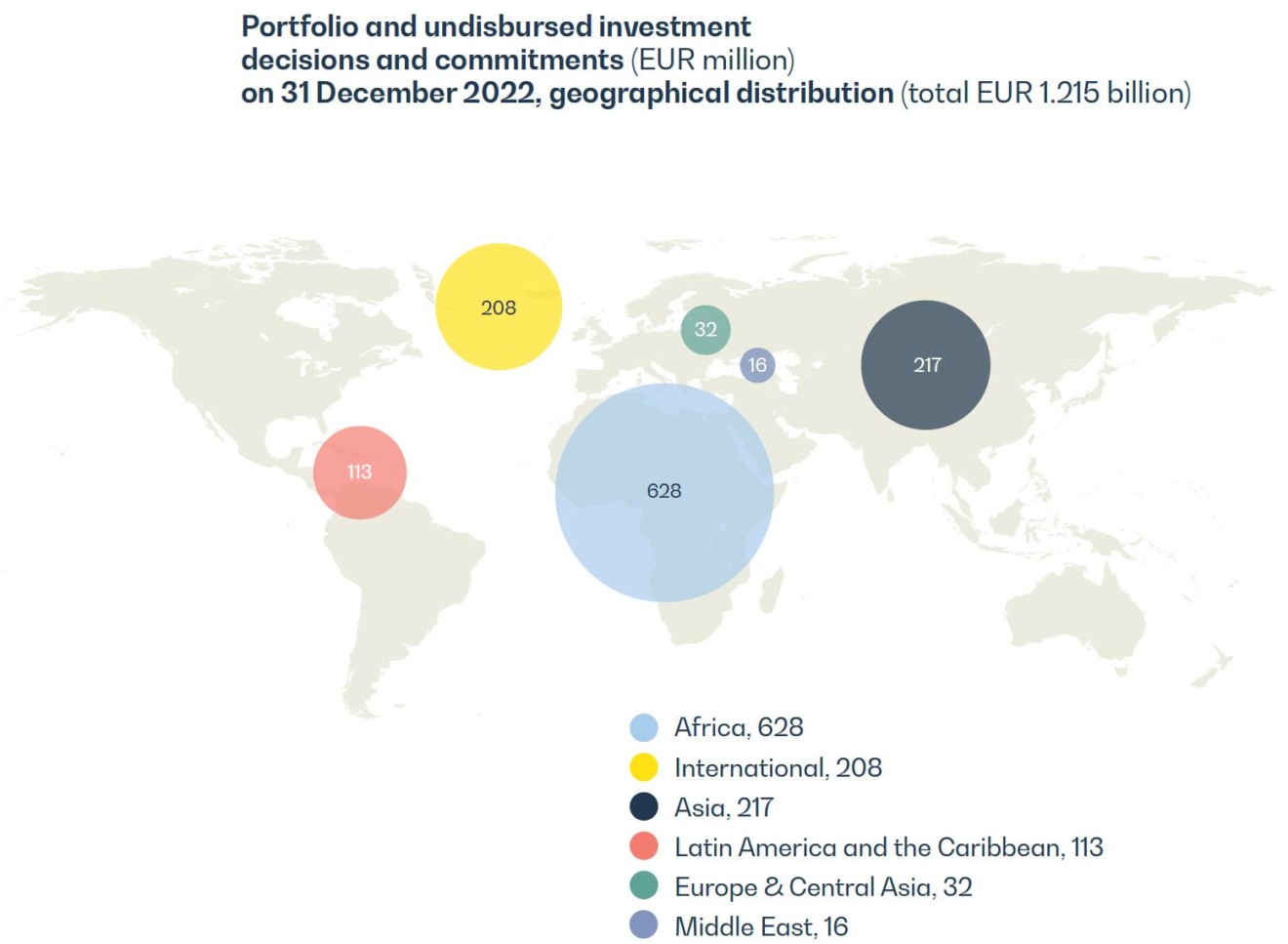

Last year, the Finnfund’s investment portfolio grew from EUR 780 million to EUR 810 million. Finnfund’s investments, commitments and investment decisions totalled about EUR 1.22 billion at the end of the year. Read more

|

|

|

|

|

|

Finnfund’s 15 million USD investment in Horizon Capital Growth Fund IV provides growth equity capital to Ukrainian technology and export-oriented companies

|

|

“The role of Finnfund and other development financiers is very important now that commercial investors hesitate,” said Jaakko Kangasniemi, Finnfund’s Managing Director and CEO, said in an in-person signing ceremony held in Kyiv with president Volodymyr Zelenskyy and investors. Read more

|

|

|

|

|

|

Finnfund invests 8 million US dollars in Menengai Geothermal Project in Kenya

|

Finnfund is one of the investors financing a geothermal project in Nakuru County, Kenya. “This investment is yet another step in

Finnfund’s commitment to make EUR 1

billion of new investments in climate

finance by 2030," said Helena Teppana, Associate Director at Finnfund. Read more

|

|

|

|

|

|

Kristiina Karjanlahti: Frontier markets are facing a credit crunch and heightened risk of debt distress

|

|

“While increasing access to finance at lower yields helped spur growth and investments, it also pushed up levels of government debt and debt service costs. This is exposing countries with still fragile macroeconomic fundamentals to the volatility of global financial markets”, says Kristiina Karjanlahti, the Lead Economist at Finnfund, the Finnish development financier. Read more

|

|

|

|

|

|

Finnfund and MLR Forestal to work on an innovative biodiversity remediation programme in Nicaragua

|

|

Finnfund and MLR Forestal, a Nicaraguan agroforestry company, have launched an innovative pilot project to restore 554 hectares of degraded forest lands with significant biodiversity potential in Nicaragua. Read more

|

|

|

|

|

|

Finnfund invests in Evolution III to foster the availability of clean energy and climate mitigation in Africa

|

|

Finnfund has announced a USD 20 million commitment to Evolution III Fund, a Pan-African equity fund aiming to foster the availability and accessibility of clean energy and increase energy efficiency. Read more

|

|

|

|

|

|

Terhi Koipijärvi: Strategic thinking over administration

BLOG – "What is most important in Board work? How to draw the line between operational and strategic thinking? How to avoid getting bogged down in administration? What is it like to serve on the Board of the largest forestry company in East Africa?"

|

|

Terhi Koipijärvi, a corporate responsibility and forestry expert, shares her insights after serving for about two years as a Board member and the Chair of the ESG committee at Green Resources AS.

|

|

|

|

|

|

|

|

Anne Arvola: We got a deal from Montreal COP15 – then what?

|

BLOG – "So, we got our 'Paris moment for Nature' but it will only be such if the agreement leads to real implementation activities. We have had global biodiversity agreements before, but the world has failed to deliver those promises. We cannot afford it to happen this time," writes Anne Arvola, Finnfund's Senior Development Impact Adviser, in the aftermath of COP15 on biodiversity.

|

|

|

|

|

|

|

|

|

Kentegra Biotechnology: Impact flowers in Kenya

VIDEO – Did you know that pyrethrum, an organic insecticide made from flowers, was once one of the main exports from Kenya? Kentegra, established in 2017, produces pale refined extract from the pyrethrum flower, sourced mainly from smallholder farmers. The company also operates nurseries in Kenya, where it grows seedlings, which are sold to approximately 10,000 farmers to grow pyrethrum flowers.

|

|

“Kentegra is an investee company that ticks all three boxes we look at in our investments. Firstly, there is great commercial potential; the company operates in a very attractive market with lots of future growth potential. Secondly, it is very sustainably run, with a professional and committed team. And thirdly, there is a great development impact; farming of pyrethrum can again be a life-changing opportunity to the farmers in the region,” says Johanna Raehalme, Head of the Nairobi office at Finnfund.

|

|

|

|

|

|

|

|

More than 50% of our investments are in Africa

In 2022, the project preparation targets – 230 million euros and 22 projects – were clearly exceeded: a total of 28 new projects totalling 246 million euros were prepared fully in 2022.

|

|

Africa continues to be Finnfund’s primary investment destination, with 57% of volume and 54% of decisions. Asia comes second, with slightly less than a quarter of investments. The remaining share, about 20 per cent, was allocated to other continents or international projects. Read more

|

|

|

|

|

Interested in knowing more?

|

|

|

|

|

|

|

Finnfund is a Finnish development financier and impact investor. We build a sustainable future and generate lasting impact by investing in businesses that solve global development challenges. We invest 200–250 million euros in 20–30 companies in developing countries each year. Our focus sectors include renewable energy, sustainable forestry, sustainable agriculture, financial institutions, and digital infrastructure and solutions. Today Finnfund’s investments, commitments, and investment decisions total about 1.22 billion euros, half of them in Africa. The company has 100 employees based in Helsinki and Nairobi. For more information, please visit www.finnfund.fi

|

|

|

|

|

|

|

|